By 2050, every building in Flanders must be climate neutral. That means: 100,000 energy renovations per year. For now, the region is not on track to achieve such results: renovation rate is 3 times too low and renovations often do not improve energy efficiency in any meaningful way.

Several conditions are required to increase the number of deep renovations and reach the 2050 targets. One of them is to implement strong support (guidance, financing and incentive) measures to make energy renovations accessible to all households.

Yet, despite the existing premiums, 40% of Flemish homeowners cannot finance an energy renovation. Bond Beter Leefmilieu commissioned Climact to conduct a study to identify the required pre-financing mechanisms to make energy renovation accessible to all Flemish households.

In this context, Climact’s study focuses on identifying and structuring:

The financial barriers to renovation investments towards a carbon neutral building stock.

To achieve its ambition of 100,000 renovations per year, the Flemish government created premiums and interest-free loans. Yet, this approach has reached its limits:

- The maximum loanable amount is not high enough to cover the energy renovation costs of the worst-performing buildings

- Some households cannot afford the monthly repayments (they face financing gaps ranging from 0 to more than 50,000€) or has no access to long-term financing schemes.

- Grants create a Mattheus effect: the premiums mainly end up with people who would already carry out a renovation without subsidies.

The elements to be considered to make energy renovations accessible to all

There are two possible approaches to address these financial barriers, strengthening public financing or supporting access to financing for vulnerable households via relevant pre-financing mechanisms.

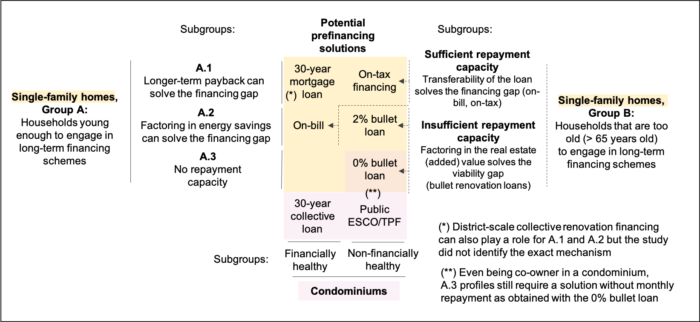

Climact suggests that a portfolio of mechanisms is needed. The most relevant financing solution will be different depending on the targeted household profiles and dwellings’ type (single-family houses or condominiums). To this end, public interventions must be focused where it is the most needed. Among households that cannot finance their energy renovation, Climact distinguishes the following groups and identify the most relevant financing solutions for each household profile (see Figure 1):

- Group A: homeowners that can engage in long-term financing schemes but don’t have the financial capacity to cover the monthly repayments.

A.1. Those that face relatively minor financial constraints

A.2. Those excluded from the first subgroup (A1), with too low monthly repayment capacity, yet, with the ability to pay relatively normal to high energy bills.

A.3. Those with no repayment capacity, including those that are barely (or not at all) able to pay their energy bills, and are at risk to (or already) live in energy poverty.

- Group B: older (>65 years old) homeowners that cannot engage in long-term financing schemes for which the financial barrier can be addressed with financing mechanisms that allow transferability or that factors the real estate (added) value in the financial plan.

Figure 1. Recommended portfolio of prefinancing mechanisms by household segment

The political actions to be implemented and the priorities to be addressed in the short and medium term.

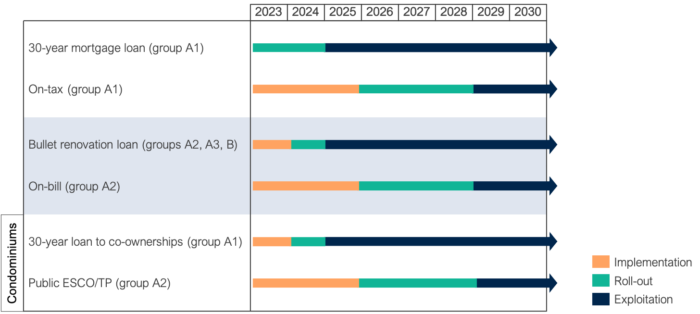

On the short term, the study suggests that the focus should be put as much as possible on market-based solutions to ensure rapid and feasible scale up. Financing solutions can be organized in two groups based on their level of maturity (see Figure 2):

- Mechanisms that build on existing market-based solutions and can be implemented in the short term (coming months). These mechanisms are the most mature and ready to scale. The focus should thus be put on adapting the related existing financing mechanisms and legislative framework to ensure their implementation in the short-term. Namely, 30-year renovation mortgage loan; Bullet renovation loan. It is a special form of mortgage loan where the homeowner pays back the capital at the time of sale or property transfer. This loan is granted based on the value of the property and not on the income; Long-term renovation credit to condominiums.

- New mechanisms that will require longer implementation (min 2 to 3 years) and roll-out (min 5 years) periods. These mechanisms show great potential in terms of creating a well-functioning financial market for energy renovations. The focus should be put on identifying the most adequate business model, to set-up the required legislative framework, and to conduct a pilot in the following years. Namely, On-tax and on-bill financing are an innovative way to finance energy efficiency investments in the building sector where the investment is repaid either through a special charge added to the property taxes during a certain period (on-tax) or using the energy bill as a repayment vehicle (on-bill); A public ESCO (Energy Service Company) and third-party investor for condominiums is a scheme where a public(-private) company provides technical assistance, oversees the renovation works and pre-financing the renovation costs as third-party investor.

Figure 2. Recommended planning for implementation and roll-out of the identified prefinancing mechanisms

Get in touch with our experts

Contact us