The EU emission trading system (or EU ETS) puts a price on carbon for EU heavy industry, power plants and the aviation sector. Covering +/- 45% of total EU GHG emissions, it is one of the cornerstones of the EU climate policy framework. Therefore, it is important to align this system with the -55% emission reduction objective the EU has set itself for 2030.

To this end, in July 2021 the European Commission has proposed a number of changes to the system, which include:

- Adjustment of the emission ‘cap’ to align with the -55% reduction objective.

- Extension of emissions trading to new sectors such as maritime (under the existing system), and buildings and road transport (under a separate system).

- Earmarking more of the system’s financial revenues for climate action.

- Strengthening reduction incentives for industrial sectors, i.a. by reducing the level of free allocation.

Open-source simulation model

Climact has developed a detailed open-source model to simulate the functioning of the system, and used this model to assess the impact of the Commission’s proposal.

Full report on the Commission’s proposal

The findings of our analysis are included in a short report which will presented and discussed at the Carbon Pricing Hub launch event on 25/1/2022.

Key study findings

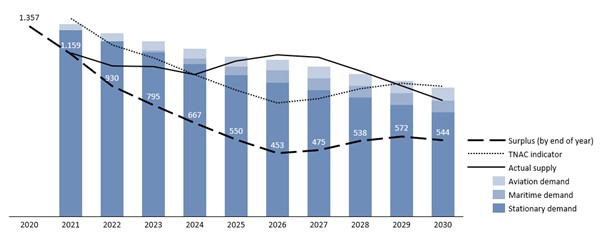

Key finding 1: despite a tighter emission cap, the surplus of allowances on the market could start to increase again after 2025

The Commission proposal would reduce the overall emission budget for the period 2021-2030 by -10% compared to the current legislation, even with the maritime sector added to the system. Nevertheless, if emissions are reduced in line with the overall -55% objectives, the system would put more allowances on the market than required. As a result, the surplus of allowances on the market would start to increase again after 2025, and would hover between 450 and 575 million in the second half of the trading phase.

Figure 1: evolution of the allowances surplus under the Commission proposal (in Mt CO2eq.)

Key finding 2: this surplus could bring the overall -55% reduction objective at risk. Several solutions could be considered.

This surplus could endanger achievement of the reduction objective by 2030. At worse, it could allow emissions from the ETS sectors to be reduced by only -57 to 58% compared to the -62% required to meet the economy-wide -55% reduction objective, meaning that other sectors should do more.

There are two possible solutions for this (which are not mutually-exclusive):

-the cap could be further adjusted to better align it with actual emission levels;

-the Market Stability Reserve could be strengthened by coupling its thresholds with the declining emission cap .

Both options have their specific impacts. The impact is largests when both options are combined.

Figure 2: evolution of the allowances surplus under different policy options (in Mt CO2eq.)

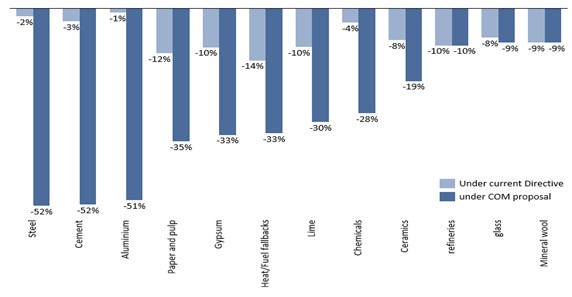

Key finding 3: all sectors will see their free allocations reduced. However, there are significant differences between sectors

At constant production levels, the number of allowances industry receives for free would decrease by on average -37% by 2030 (compared to 2021 levels). This is significant, but less stringent compared to the cap which would reduce by 50% in the same period. There are however important differences between different sectors:

- sectors which would be covered by a Carbon Border Adjustment Mechanism (steel, cement, fertilizers and aluminium) would see their allocations reduced the strongest, by at least -50%

- for other sectors such as paper & pulp, gypsum, lime, chemicals, ceramics and sectors falling under the heat/fuel benchmark approach, the impact is lower between -19% and -35%

The impact of the Commission proposal is expected to be lowest for the refinery, glass and mineral wool sectors.

Other developments such as changes in production levels, benchmark definitions and the link with energy efficiency improvements could further reduce allocation levels

Figure 3: evolution of free allocation levels between 2021 and 2030 (in %)

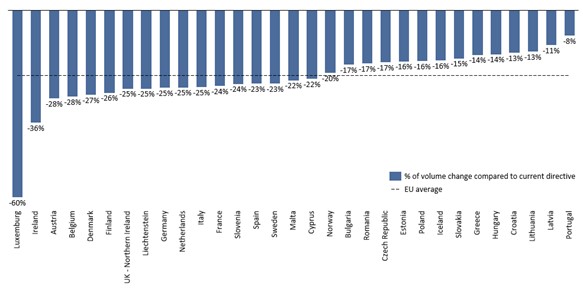

Key finding 4: all member states will see their auctioning volume reduced, with a stronger reduction for higher-income member states. However, this reduction is more than compensated by higher carbon prices.

On average, the amount of allowances that memer states can put to auction (including those auctioned via the Modernization Fund) would reduce by 21% compared to the current legislation. On average, we expect a higher impact for higher-income member states (-25% on average) compared to lower-income member states (-17% on average), due to the increase of the Modernisation Fund.

However, the decrease in volumes would probably be more than offset by a higher carbon price, meaning overall revenues are expected to be higher compared to if the current Directive would remain unchanged.

Figure 4: changes in auctioning volumes for the full period 2021-2030 per member state (in %)

Key finding 5: the Modernization Fund and the Innovation Fund are increased significantly.

Auctioning volumes are expected to increase considerably for the Modernisation Fund (+26%) and even more so for the Innovation Fund (+124%). Together with a strong carbon price, these Funds will become ever more important tools to support the transition in the different sectors and Member States.

Changes in auctioning volumes for the Modernization and Innovation Funds (in Mt CO2eq.)