Context and goal of the study

The European natural gas market has been under tension for the last year in the context of the post-covid economic recovery and, lately, the war in Ukraine. This gave rise to growing awareness about the need for Europe to reduce its dependence on natural gas imports, particularly from Russia. Indeed, the total 155 bcm of natural gas imported from Russia accounted for around 45% of the EU’s gas imports in 2021 and almost 40% of its total gas consumption.[1] While this is a major challenge, it also represents an opportunity to accelerate the climate transition to a more efficient energy system fueled with cleaner energy.

In this context, the European Climate Foundation has asked Climact to

- Identify the natural gas consumption hotspots in the EU industry

- Investigate for these hotspots the best alternatives to natural gas in the short term, i.e. those that enable to quickly and significantly reduce the natural gas consumption, whether through process change, energy efficiency or fuel switch.

- Assess the costs and benefits of these alternatives

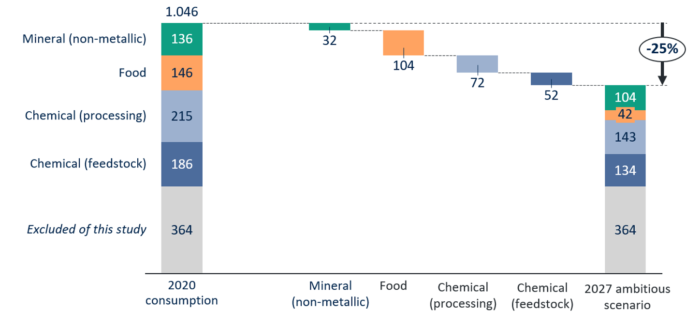

Parts (i) and (ii) were addressed in a previous article, where 4 industry sectors were identified that collectively amount to two-thirds of the EU industry’s natural gas demand: the chemical sector (natural gas as an energy vector and as a feedstock), the food and drink industry, the glass and the ceramic sectors. The best short-term alternatives to natural gas for these 4 sectors and their natural gas use reduction potential were determined and it was estimated that around a quarter of current consumption could be reduced in the next 5 years (see Fig. 1).

Figure 1: Short-term reduction potential of natural gas use in 4 industrial hotspots in an ambitious phase-out scenario (TWh of natural gas)

This article assesses the costs and benefits of the best alternative (with the highest short-term reduction potential for natural gas use) three of these sectors: food, chemicals and glass.

The assessment is based on:

- a literature review and a review of existing pilot projects to assess real-life OPEX and CAPEX for such alternatives, as well as the payback period

- a comparison of these figures to those of the current gas-based process over the lifetime of installation, in two different energy prices scenarios

Several factsheets are also presented in the detailed study that present pilot projects where such alternatives to natural gas have been implemented. These factsheets include information about the investment context, the CAPEX and OPEX and the payback time for these projects.

Main findings

Food sector

In the food sector, low-temperature (i.e. inferior to 100°C) heat pumps (LT HP) present the largest short-term potential to reduce natural gas consumption. Indeed, these are able to match the needs of numerous processes in the food industry: drying, cooking, heating/cooling water (e.g., washing water), heating/cooling steam (e.g., to sterilize products). The temperature can be increased via hybrid heat pumps and electric boilers.

The median investment cost for low-temperature heat pumps in the 0.5 to 5 MWth range is 400€ per thermal kilowatt and per year, which gives 8000€ per kw for the 20 years of its lifetime, or 8 M€ for 1 MW installation. It is around 3 times more expensive than regular gas boilers in terms of initial investments.

On the other hand, as heat pumps consume 3 to 7 times less energy than gas boilers, their fuel costs are much lower. Hence, the benefit of switching from natural gas boilers to low-temperature heat pumps will essentially depend on the proportional difference between gas and electricity prices. Under the considered forecasts for electricity and gas prices (see the study for details) and considering a yearly runtime of 6400h, the fuel cost of a LT HP is around 200€/kWth/year, while for gas it is around 500€/kWth/year (including a CO2 cost of 200€/kWth/year).

Under higher energy prices assumptions (see study for details), the fuel expenses respectively amount to 480 and 1580€/kWth/year for heat pumps and gas boilers. Hence, the higher resilience of HP against increasing energy prices is a key advantage compared to gas boilers.

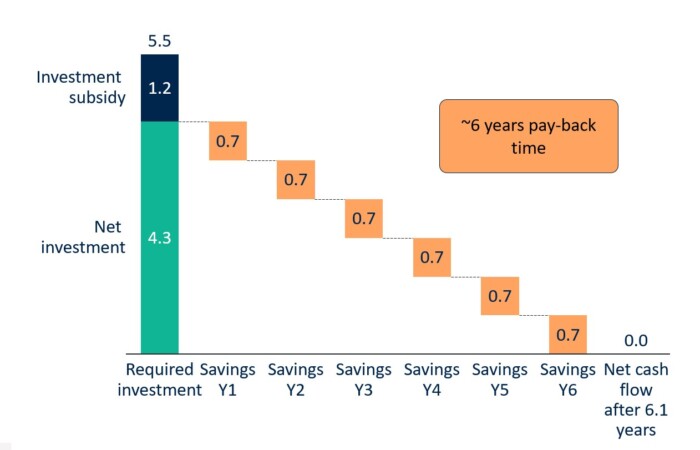

Pilot projects include the Rødkærsbro plant, property of the Scandinavian dairy cooperative Arla, which mainly processes raw milk to form cheese. A heat pump with a 1.5 MWth heating capacity and a 1 MWth cooling capacity was installed on the premises in 2014. For this particular project, the CAPEX was 5.5 M€ for an equipment lifetime of 20 years and operations and maintenance (O&M) amount to 4 €/MWhth. This project benefited from a 1.2 M€ investment subsidy. The installation of the heat pump allows to save 16 010 MWh and 2980 tons of CO2 each year. With these energy savings and the initial investment subsidy, the heat pump installation became profitable after 6.1 years.

Chemical sector

When it comes to energy-consuming processes in the chemical sector, heat pumps and electric boilers are the alternatives with the largest short-term potential to reduce natural gas consumption. However, higher temperature needs than in the food sector might represent a barrier to the use of heat pumps in the chemical industry. High temperature heat pumps (HT HP) constitute an emerging technology (currently able to produce heat up to around 200°C) and may address part of this challenge.

Due to the lower maturity of this technology, CAPEX are still significantly higher than for LT HP, around 22 040 € per thermal kW. Higher market penetration should help to decrease the cost of this technology. Among existing HT HP examples, the Belgian company Qpinch manufactures high temperature chemical heat pumps able to harvest up to 50% of waste process heat and convert it to 230°C process heat.

Pilot projects for this technology include the Borealis Zwijndrecht plant where a 1.3 MWth HT HP was installed in 2021 to harvest the plant waste heat. This HT HP consumes 50kW of electricity to produce 1.3 MWth of useful heat. The CAPEX is 2,6 M€ for a lifetime of 20 years. In this case, the payback period has been assessed to be in a range from 3 to 5 years. This HT HP delivers a yearly natural gas consumption reduction of 10 600 MWh of gas and reduces the plant yearly CO2 emissions by 2200 tons.

Glass sector

In the glass sector, direct electrification (e.g., electric furnaces) represents the best short-term alternative to natural gas. Partial electrification in existing lines, called electric boosting, consists in introducing electrodes in the glass bath while keeping the existing gas burners. It presents the advantage that it does not require a new installation and can be relatively easy to implement in existing lines, which makes it the easiest solution in the short term. In the longer term, full electric furnaces or hybrid furnaces coupled with hydrogen will become a viable solution. The ratio between gas and electricity can then be adapted to maximize the utilisation of electricity as long as the produced glass keeps the same quality.

Container glass manufacturers already have some electric boosting in their production lines and vary the ratio of electricity between 5-15% depending on the energy price. AGC has been electrifying their plants since 2020. A year ago, they opened their first hybrid plant in Belgium. To reach the necessary temperature, they currently use 90% of gas and 10% of electricity. However, the aim is to increase the use of electricity through resistances as much as possible. For this project, AGC benefited from subsidies from the Belgian government covering 30% of the CAPEX.

Perspectives

The current article focuses on the differences between investment and fuel costs when switching from gas-based processes to alternatives. From an industry point-of-view, the balance between costs and benefits is indeed very important to inform such investment decisions. However, other elements also need to be factored in the decision process that were not considered here: long term energy purchase agreements, remaining lifetime of existing facilities, sufficient electricity transmission or distribution capacity at the considered plant,… These are key enablers for a successful switch from natural gas to electricity that should not be overlooked.

Another element to bear in mind is that the cost comparison between natural gas-based processes and alternatives is based on current energy prices forecasts, mainly based on the observation of future commodity markets. However, these markets do not capture the totality of the electricity being sold or bought (e.g. on day-ahead or intraday markets). Furthermore, discussions are currently being held at the EU level to control the increasing price of energy. One of them concerns a proposition to cap the price of electricity on spot market (day-ahead or intraday) by fixing maximum prices depending on the production technology. These elements lead to be cautious when comparing natural gas-based solutions and alternatives based solely on price forecasts as these currently present a high level of uncertainty.

Finally, the study also mentions a set of subsidy tools available to help companies implement alternatives to natural gas in their processes. Numerous pilot projects mentioned in the study benefited from such subsidies, which helps to reduce the payback period when carrying out these investments. To facilitate the process of phasing out the use of natural gas in the EU industry, it is important for companies to be aware of existing support schemes that might help making investments in alternatives to natural gas profitable.

>> DOWNLOAD THE PUBLICATION HERE

“This project has been supported by the European Climate Foundation. Responsibility for the information and views set out in this analysis lies with the authors. The European Climate Foundation cannot be held responsible for any use which may be made of the information contained or expressed therein.”

[1] IEA : A 10-Point Plan to Reduce the European Union’s Reliance on Russian Natural Gas

Get in touch with our experts

Contact us