Belgium’s nuclear policy has taken a significant turn. After decades of planning to phase out reactors, the government led by Prime Minister Bart De Wever is now charting a radically different course— planning to revoke the previous phase-out law, to extend the lifetimes of existing reactors (notably Doel 4 and Tihange 3 until 2045), and considering new builds to reach up to 8 GW of nuclear capacity.

These announcements, made by Energy Minister Mathieu Bihet on February 4th, 2025, could reshape Belgium’s electricity landscape and leave a lasting impact on both energy security and climate strategies.

Shifting Belgian energy policy : insights from Elia’s Blueprint

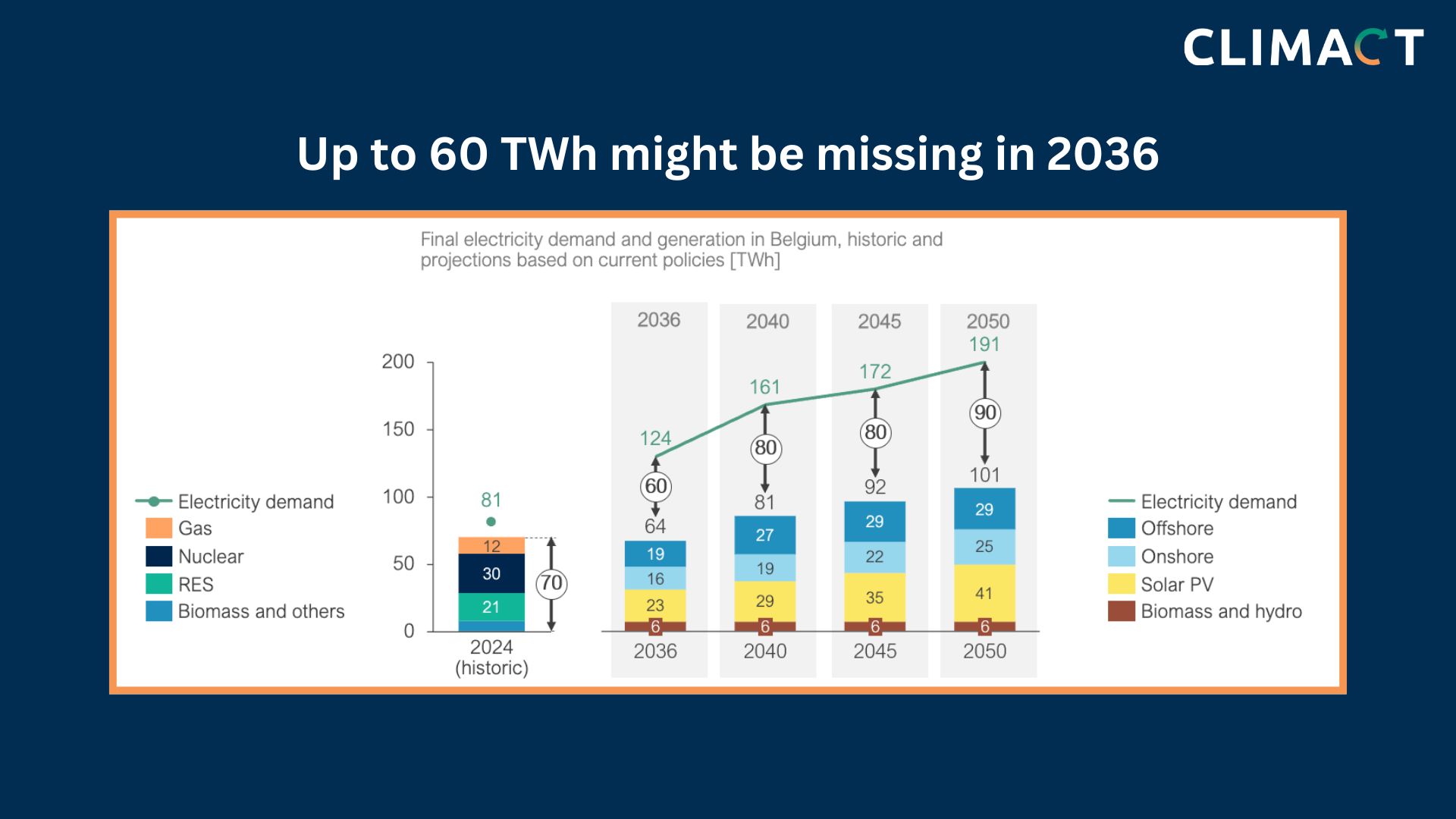

Elia recently published its Blueprint study, investigating the potential evolutions of the Belgian electricity production mix. The study highlights escalating pressures on the nation’s power grid, as electricity demand rises due to the electrification of end-uses – a necessary step to reach our GHG emissions reduction targets.

The study projects that without decisive action, Belgium could face a 60 TWh gap in electricity generation by 2036—a shortfall that could swell to 90 TWh by 2050.

To put this in context, those deficits represent about half of the country’s expected electricity consumption, raising serious concerns about the affordability and reliability of supply for households and industries alike. Significant and quick measures are then required, for the “doing nothing more” scenario leads to the costliest path.

Non-domestic offshore and nuclear: the most cost-effective options

Extending existing reactors: a short-term fix

One of the government’s key moves is to prolong the life of all current nuclear reactors. According to Elia’s calculations, keeping them operational until 2045 could supply around 30 TWh of electricity, mitigating some of the generation gap and providing near-term security.

This extension is considered relatively cost-effective, especially given the existing infrastructure. However, with electricity demand expected to climb sharply (driven partly by electrification of heat and transport), these measures alone will not fully close the gap.

Doubling capacity to 8GW: enter SMRs

Alongside reactor extensions, the government also plans to boost overall nuclear capacity from 4 GW to 8 GW by introducing new units, including Small Modular Reactors (SMRs). Elia’s Blueprint identifies SMRs as the second most cost-effective solution after offshore wind—largely due to their flexibility and reliability.

Yet SMRs come with cost sensitivities: if investment expenses run higher than anticipated, overall electricity costs could rise by up to 20%. Moreover, SMRs typically can’t deliver significant volumes before the mid-2030s, whereas offshore wind could already contribute an additional 15 TWh by that time.

Offshore wind: a quicker win

Offshore wind — particularly from sites outside Belgium’s territorial waters — emerges in the Blueprint as a more resilient, less risky option. If wind-related capital costs go up, electricity would still only be about 10% more expensive (compared to the potential 20% jump for SMRs). And crucially, offshore wind can deliver new generation capacity sooner, helping to alleviate the 60 TWh shortfall well before SMRs are up and running.

Which are the other opportunities?

Scaling up domestic renewables

For onshore renewables, the study estimates that Belgium could add 9 TWh of new solar PV and wind production by 2036, and up to 53 TWh by 2050 — but only if the country surpasses its current National Energy and Climate Plan (NECP) goals.

This would require doubling onshore wind installations and quadrupling solar deployments — an ambitious target given that Belgium is already struggling to meet existing benchmarks. For example, in Wallonia, onshore wind and solar PV capacities must double in the five upcoming years to meet the 2030 regional target. Falling short of today’s NECP goals would widen the generation gap even more.

The power of energy sufficiency

Beyond infrastructure investments, Elia also highlights the sizable impact of energy sufficiency measures. Behavioral changes and structural shifts could collectively curb electricity demand by up to 18 TWh by 2036 and 22TWh by 2050, from which 10TWh could be obtained by playing on behavioral levers alone:

- 5TWh of which could- be obtained with low efforts measures (e.g., lowering thermostat settings or optimizing consumption patterns),

- other 5TWh could be obtained, but would require longer-term change (like smaller cars and homes).

This approach not only saves energy; it reduces Belgian electricity system costs by an estimated 15–20 €/MWh and could reduce by 2–3GW the adequacy capacity.

Gas-fired power: a double-edged sword

Although extending the lifetime of gas-fired power plants could provide an additional 15 – 30 TWh, heavy reliance on fossil fuels would place Belgium’s longer-term climate goals at risk. The government must therefore carefully align short-term reliability needs with the broader objective of achieving carbon neutrality by 2050.

Beyond electricity: a broader energy transition

Coordinating across borders and sectors

But achieving this broader transition isn’t just about new technologies, it hinges on coordinated efforts among all stakeholders, from federal and regional governments to neighboring countries and cross-industry coalitions.

Elia’s Blueprint highlights the fact that planned generation alone won’t be enough to produce domestic demand and that, if no additional measures are taken, we will heavily rely on neighboring countries. But it does not mean that Belgium should not import electricity from countries having higher RES potentials: energy security of supply could also be met by backing up those cheap electricity imports with flexibility means (i.e. Demand Side Management, grid-scale or domestic-batteries, thermal energy storage, etc).

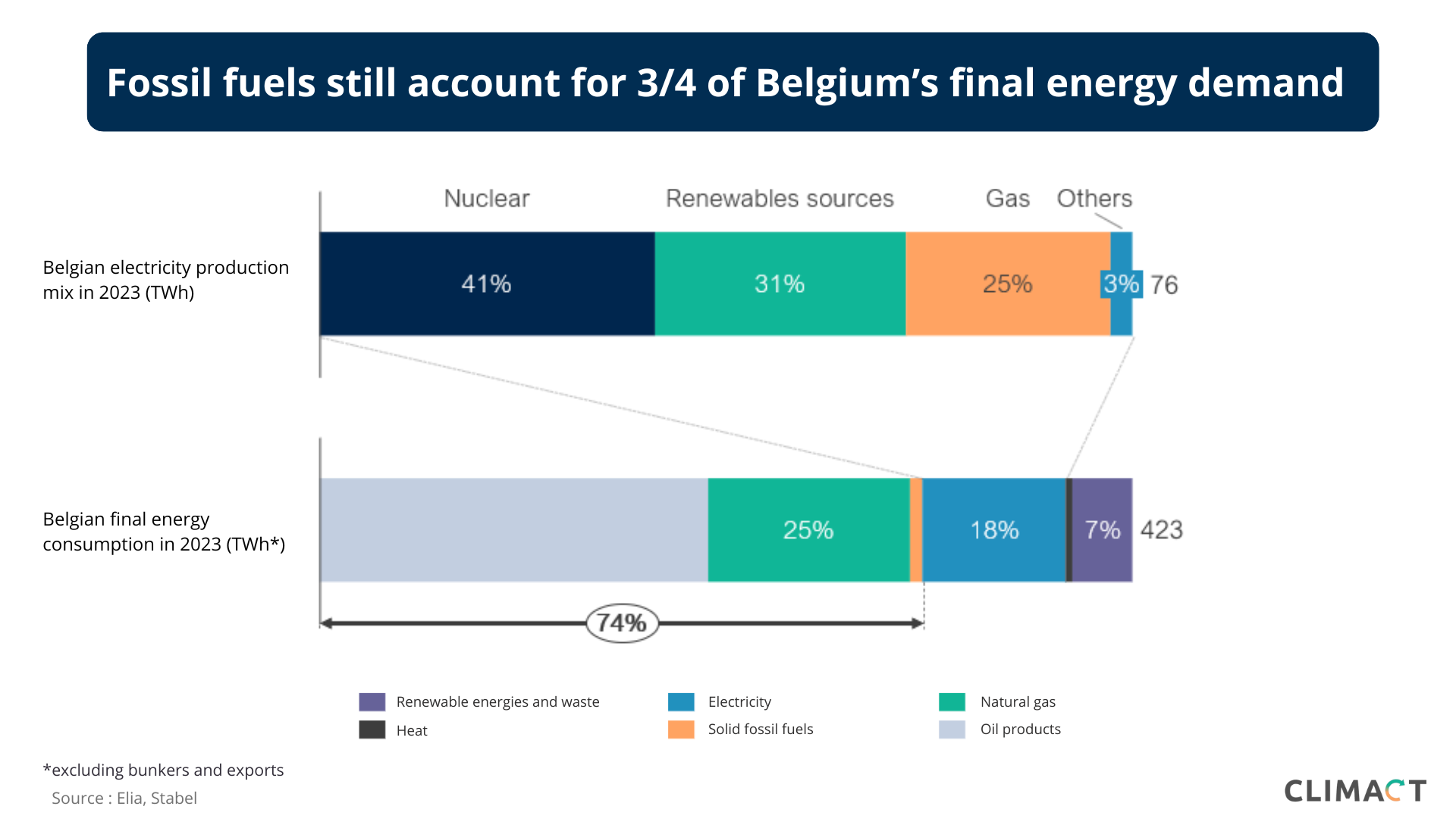

Because energy is not limited to electricity

When discussing the future evolution of energy systems, it is sometimes crucial to take a step back – crucially, electricity still makes up a relatively small share (18%) of Belgium’s overall energy mix. While nuclear-produced electricity dominates the headlines, it only represented 7% of the final energy demand in Belgium in 2023.

In the meantime, oil products (48%) and natural gas (25%) still dominated overall consumption, meaning that decarbonizing the rest of the energy system — transport, heating, industry—remains a massive undertaking.

Failing to see the big picture not only occults the potential of cross energy carrier flexibility (e.g. using heat pumps when the RES electricity production is high and storing it to curve down evening demand peaks) – it hides the urgency and the size of the problem we must tackle if the country is to meet its net-zero emissions targets by 2050.

Climact’s expertise: navigating complex pathways

At Climact, we offer specialized support for organizations navigating Belgium’s evolving policy landscape. We combine:

- Pathways Explorer: a user-friendly tool that helps design and compare decarbonization scenarios,

- PyPSA-Eur: an open-source, large-scale energy system model that evaluates system costs, security of supply, and infrastructure needs for predetermined energy demand scenarios.

If you wonder:

– Which mix of solutions offers Belgium the most resilience and energy security?

– What impact could those changes have on transmission and distribution infrastructure needs?

– How can we achieve the ambitious 18 TWh of energy efficiency mentioned by Elia ?

– Which could be the role of renewables and hydrogen and the impact of a nuclear-driven strategy on your organization’s decarbonization roadmap?

– How could evolving policies impact your organization’s energy strategy?

Let’s connect! We tackle these questions every day — and we’d love to explore them further with you, backed by our top experts and cutting-edge modeling expertise.

Let’s build a more resilient, secure, and sustainable energy future and start exploring relevant decarbonation scenarios for your organization here : www.pathwaysexplorer.org

Sources

Belgian electricity system blueprint for 2035-2050 by Elia Group – Issuu

https://economie.fgov.be/fr/publications/belgian-energy-data-overview-2

Latest news & publications

-

Legal & Regulatory Advisory

The Clean Industrial Deal (CID): a new era for European industry balancing competitiveness and sustainability

-

News

SBTi remains the most robust way to demonstrate a company 1.5°- aligned ambition

-

Industry and services

Why is it essential for SMEs to build a climate strategy?